BAS agent lodgment program 2022–23

The BAS agent lodgment program 2022–23 includes:

- lodgment and payment concessions when you have elected on behalf of your client to receive and lodge eligible quarterly activity statements online

- a lodgment concession for pay as you go (PAYG) withholding payment summary annual reports (not the closely held concession)

- lodgment and payment concessions where your client is an active STP reporter and has elected to receive and lodge a paper activity statement.

To ensure your clients receive the full lodgment program concessions, you should lodge activity statements (December monthly, and all quarterly activity statements) using either of the following channels:

On this page:

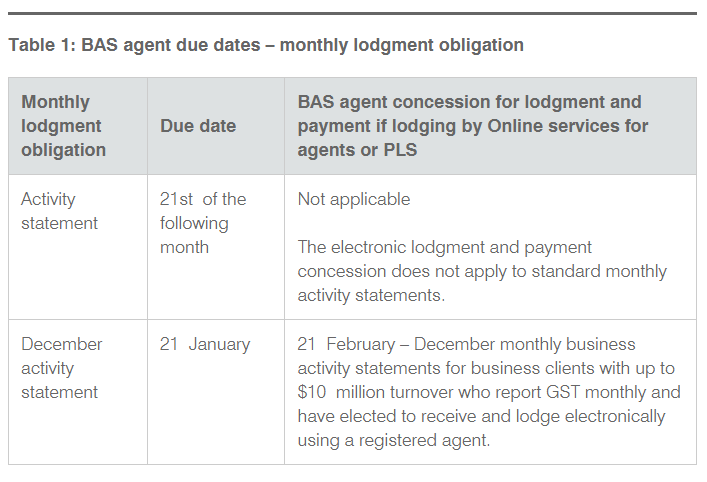

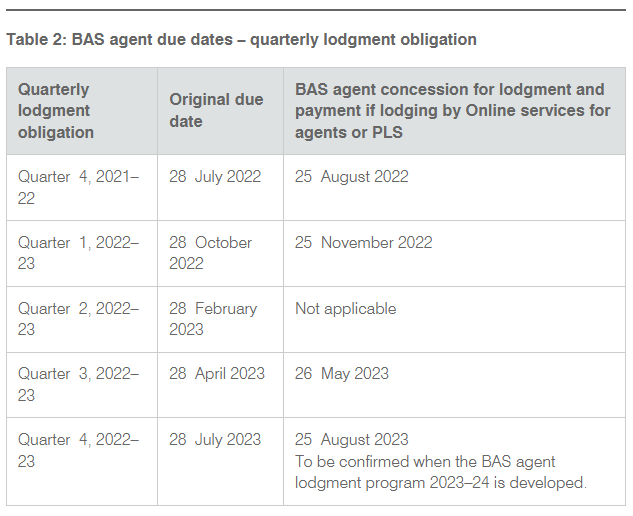

Lodgment and payment due dates

The lodgment program due dates for quarterly activity statements (and December monthly) will now show on your client lists. This is where your client has elected to receive and lodge the activity statement electronically and the activity statement meets the eligibility criteria.

Other lodgment obligations

Registered BAS agents can also lodge:

- a PAYG withholding payment summary annual report

- a super guarantee charge (SGC) statement – quarterly form

- a taxable payments annual report

- payment summaries or income statements, employee termination payments, gross wages, allowances, PAYG withholding and other taxable and non-taxable payroll items

- Single Touch Payroll reports

- a tax file number declaration on behalf of a client

- an application to the Registrar for an Australian business number on behalf of a client.

The scope of services that registered BAS agents can provide to their clients was expanded in response to COVID-19. More information can be found on the Tax Practitioners Board website.

See also:

- BAS servicesExternal Link

- Tax Practitioners Board – COVID-19 newsExternal Link

If you can’t lodge on time

If you or your clients can’t lodge by the lodgment program dates because of exceptional or unforeseen circumstances beyond your or your clients’ control, you can request a deferral.

If you request a deferral, you must provide supporting reasons.